Key takeaways

Blue Cross Blue Shield may cover Ozempic for Type 2 diabetes, although it depends on the specific plan and prior authorization requirements.

Insurance plans won’t often cover the drug for weight loss, but they may cover Wegovy, which has the same active ingredient under a different brand name.

The out-of-pocket costs for Ozempic often vary based on where the plan places the drug on its tier schedule. Lower-tier drugs often have lower copays and coinsurance.

Without insurance or assistance, Ozempic’s list price is $935.77 for a 30-day supply before any discounts or rebates are applied.

Whether or not a particular insurance plan covers it, there are other ways to reduce the cost of Ozempic.

Ozempic (semaglutide) is one of the most in-demand medications for Type 2 diabetes on the market. Not only has this once-weekly injectable drug shown effectiveness in lowering blood sugar, but it’s also earned a reputation for weight loss.

Insurance companies and Medicare prescription drug plans may cover Ozempic when it’s prescribed for Type 2 diabetes, not weight loss, but it depends on the specific plan. Here’s all the information you need to determine whether your Blue Cross Blue Shield (BCBS) plan could provide some assistance.

Does Blue Cross Blue Shield cover Ozempic?

In short, maybe. BCBS isn’t just one company—it’s a network of 33 independent licensees of the Blue Cross Blue Shield Association (including Anthem and Empire), and each has unique policies. Some may cover Ozempic, while others won’t. And even with the ones that do, the amount of coverage can vary.

The insurance landscape for Ozempic and similar medications is constantly in flux, and it might feel difficult to keep up with the changes. But, according to Supriya Rao, MD, a quadruple board-certified physician and founder of GutsyGirlMD, “patients generally have been able to get BCBS coverage for Ozempic, but it depends on the individual person’s coverage.” Factors including health conditions prescribed for, drug tier, and whether prior authorization is required may influence Blue Cross Blue Shield’s coverage decision.

Health condition

Insurance companies are much more likely to cover Ozempic when it’s prescribed for diabetes than for weight loss. That’s because the Food and Drug Administration (FDA) has approved it for Type 2 diabetes, while weight management is technically an off-label treatment. Noro Nordisk has a separate semaglutide drug that’s approved and marketed for weight loss: Wegovy. For those reasons, some insurance plans might only cover Wegovy for weight loss and Ozempic for diabetes.

Prior authorization

According to Alex Foxman, MD, physician and medical director for Achieve Health and Weight Loss, BCBS Ozempic coverage almost always requires prior authorization. “Commonly, BCBS requires proof of a diagnosis of Type 2 diabetes and documentation that the patient has not adequately responded to other diabetes medications before approving Ozempic,” he says. “The insurer may also require information on the patient’s glycemic control, including HbA1c levels, and sometimes documentation of concurrent lifestyle interventions such as diet and exercise.”

Drug tier

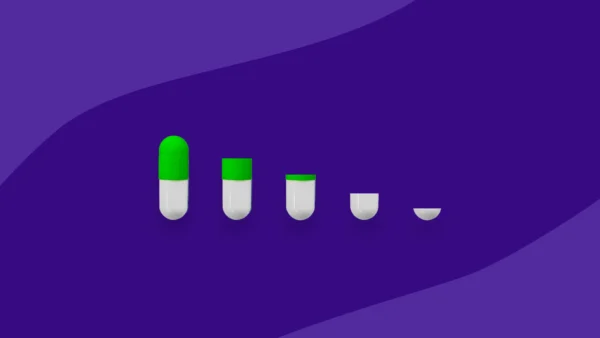

Every prescription drug plan has preferred and nonpreferred drugs. Preferred drugs are usually less expensive or have no suitable alternatives. Insurance companies often cover more of the cost for these select drugs. They might provide some coverage for nonpreferred drugs, too, but those often have higher copays and coinsurance for the patient.

Insurance providers organize those drugs into tiers. Generics typically occupy the lowest tier, then preferred brands, then nonpreferred brands, then specialty drugs at the highest tier. In most cases, the lower the tier, the lower the out-of-pocket costs—and Ozempic typically falls in one of the middle tiers.

How much does Ozempic cost?

Let’s say a particular Blue Cross Blue Shield plan doesn’t cover Ozempic. In that case, without any other assistance, the manufacturer’s suggested list price is $935.77, but pharmacies may charge more or less.

“Outside of insurance, several factors can influence Ozempic’s cost. These include the pharmacy’s pricing, the patient’s geographical location, and any applicable pharmaceutical company discount programs or patient assistance programs,” Dr. Foxman says.

When BCBS covers Ozempic, the out-of-pocket costs will vary based on the drug tier it falls in. According to a 2023 survey of 2,133 companies about their employer-sponsored health insurance, the average copay was $11 for first-tier drugs, $36 for second-tier drugs, $66 for third-tier drugs, and $125 for fourth-tier drugs.

How to check whether your BCBS plan covers Ozempic

There are two ways to check whether a BCBS plan covers Ozempic. The first is to check the plan’s formulary. Formularies are drug lists that outline where they fall in the tier system, whether they’re preferred or nonpreferred, and any prior authorization requirements. Most BCBS companies house links to their formularies in the member benefits or resources sections of their website.

The second method is to call the company and ask a representative. They may request the account and group numbers of the plan, so have those handy before calling.

Dr. Foxman recommends that every patient review their formulary to see how Ozempic is covered and communicate directly with their insurer for clarity on the specific requirements. “It’s also beneficial for patients to collaborate closely with a knowledgeable healthcare provider to ensure that all necessary documentation for prior authorization is accurate and submitted promptly,” he says. “Understanding the appeal process is also crucial in case the initial request for coverage is denied.”

How to save on Ozempic

Insurance can help make prescriptions a lot more affordable, but patients don’t have to be solely dependent on a provider’s policies. There are a few other resources you can use to save money on Ozempic, including:

- Free Ozempic coupons: SingleCare negotiates directly with partner pharmacies to get discounts on prescription medications, including Ozempic. It’s free to sign up and could knock hundreds off the price.

- Manufacturer assistance: Ozempic’s manufacturer, Novo Nordisk, has implemented a patient assistance program that could help applicants get the drug for free—but only if they meet certain qualifications.

- Ozempic savings card: For patients who have health insurance that covers Ozempic, this card from Noro Novdisk could yield savings of up to $150 for a one-month prescription, $300 for a two-month prescription, and $450 for a three-month prescription.

- Federal and state assistance: Medicare Part D beneficiaries can apply for Medicare Extra Help to help supplement their prescription drug benefits, and each state also funds prescription assistance programs for its residents.

- Comparing prices: Each pharmacy can charge what it wants for Ozempic and other drugs, and the difference between those prices could be hundreds. So, a little shopping around could help save some money.

- Asking your doctor: If your insurance denies Ozempic, “try seeing if your physician can help,” Dr. Rao says. “We can call the insurance provider and make a case for why the medication is medically necessary.”

- Considering alternatives: Ozempic doesn’t have generic alternatives, but there are other antidiabetic and weight loss drugs out there—and there’s a chance that some Ozempic alternatives could have lower prices or better BCBS coverage. Also, semaglutide is currently on the FDA drug shortage list, “which means other manufacturers can produce it,” Dr. Foxman says. “I would only recommend considering this option from a manufacturer that uses the federally approved ingredient (not Semaglutide salt).”

Even with a BCBS plan that covers Ozempic, some of these options could help save even more money. Some options only apply to people who don’t have insurance coverage. The point is, no matter what your circumstances, there are ways you can potentially lower the cost.

Sources

- BCBS companies and licensees, Blue Cross Blue Shield

- Medications containing semaglutide marketed for Type 2 diabetes or weight loss, U.S. Food and Drug Administration (2024)

- Understanding drug tiers, Patient Advocate Foundation

- Find out the cost for Ozempic, Novo Nordisk

- 2023 employer health benefits survey, KFF (2023)

- Patient assistance program, Noro Novdisk

- Ozempic savings card, Ozempic.com

- State pharmaceutical assistance programs, National Conference of State Legislatures (2022)

- FDA drug shortages, U.S. Food and Drug Administration (2024)