Simply put, Medicare is federally provided health insurance for people 65 and older as well as younger people with certain disabilities. However, Medicare is anything but simple. For many people, it’s a complicated system with a confusing enrollment process. To gauge Americans’ understanding of Medicare, we conducted a Medicare survey of 1,500 adults in America and asked them what they knew about Medicare.

Summary of Medicare survey results:

- 34% aren’t familiar with Medicare at all.

- 65% reportedly would not know which part(s) of Medicare they should enroll in.

- 28% did not know that Medicare offers prescription drug coverage.

- 19% mistakenly believe that Medicare Part D covers all prescription drugs.

- 73% did not know that Medicare Part D’s coverage gap is also referred to as the donut hole.

- 49% did not know that Medicare covers flu shots.

- 52% did not know that Medicare covers COVID tests, vaccines, and monoclonal antibody treatments.

- 31% mistakenly believe that Medicare covers long-term health care.

- 57% did not know that Medicare premiums vary.

- 58% did not know that there are different deductibles for each part of Medicare.

- 76% believe that Medicare benefits should be expanded.

- 15% believe that Medicare benefits should be decreased to reduce government spending.

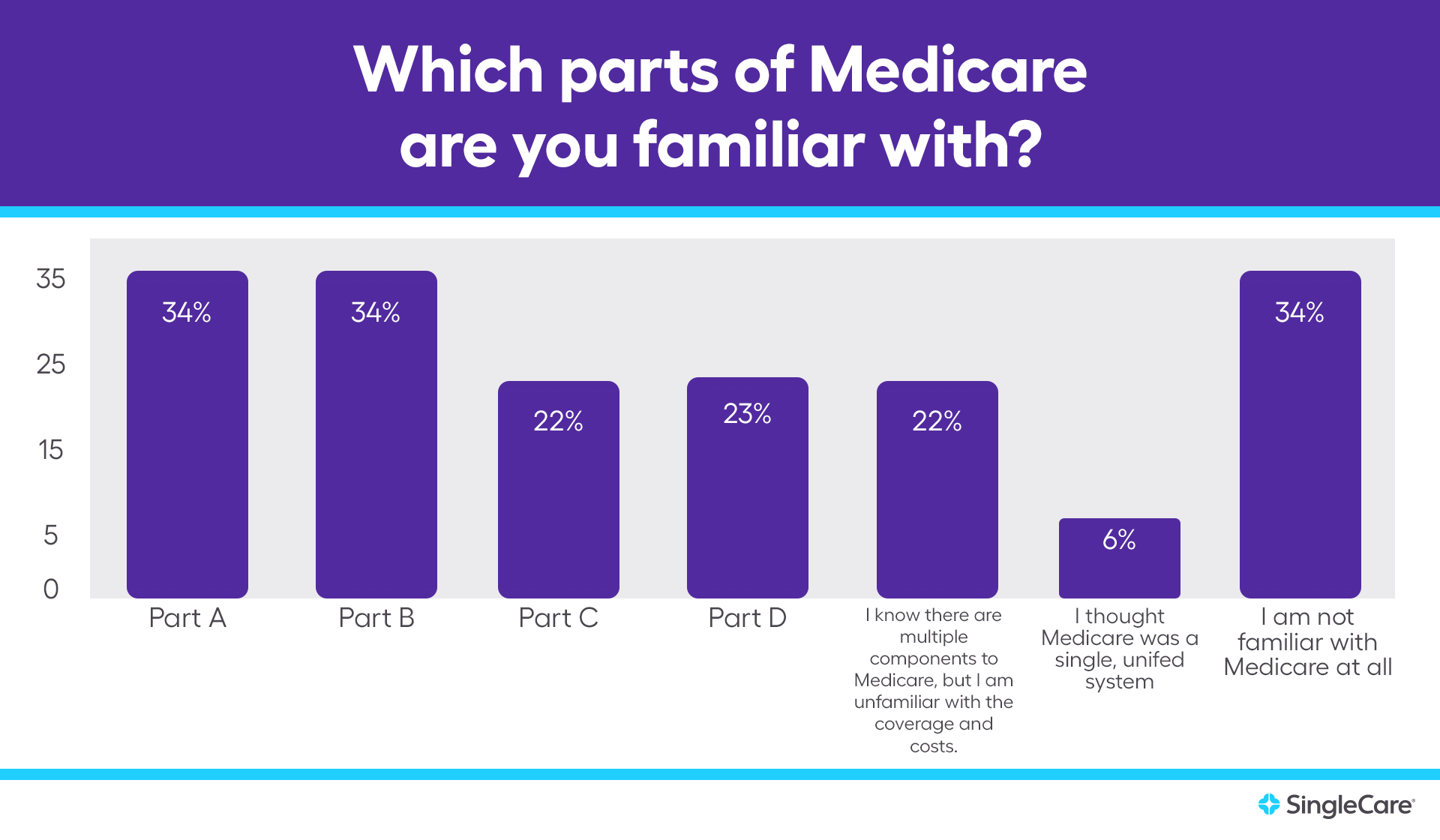

Medicare is a foreign concept to one-third of respondents

More than 61 million people are covered by Medicare, but many Americans reportedly aren’t familiar with the program at all.

- 34% of respondents aren’t familiar with Medicare at all.

- 6% of respondents thought Medicare was a single unified system.

- 22% of respondents know there are multiple components to Medicare but are unfamiliar with coverage and costs.

There are four parts of Medicare. A third or less of respondents were familiar with each part.

- 66% of respondents are unfamiliar with Part A (inpatient hospital insurance).

- 66% of respondents are unfamiliar with Part B (outpatient medical insurance).

- 78% of respondents are unfamiliar with Part C (also called Medicare Advantage, an alternative way of receiving Medicare benefits through private plans).

- 77% of respondents are unfamiliar with Part D (prescription insurance).

People who are 65 and older are eligible for Medicare. Some people may qualify before they turn 65 years old if they are disabled or have specific health conditions, including end-stage renal disease that requires dialysis or Lou Gehrig’s disease.

- 65% of all respondents reportedly would not know which part(s) of Medicare they should enroll in.

- 12% of Medicare-eligible* respondents also reported that they would not know which part(s) of Medicare they should enroll in.

* Of the 1,500 adults we surveyed, 18% were 65 years or older and therefore eligible for Medicare. There is a chance that younger respondents were also eligible for Medicare, but this was not specified in the survey.

Part D may be the most unclear part of Medicare

Medicare Part D is prescription drug coverage; however, it’s optional. People who enroll in Original Medicare will receive Part A and/or B coverage, but not Part D unless they sign up for a stand-alone prescription plan. People who enroll in Medicare Advantage (or Part C) will receive Part A and B coverage through their private plan, and typically—but not always—Part D benefits.

- Only 40% of all respondents know Medicare offers prescription drug coverage but do not know which part of Medicare offers it.

- 33% of all respondents know which part of Medicare offers prescription drug coverage.

- 18% of Medicare-eligible* respondents do not know which part of Medicare offers prescription drug coverage.

- 27% of all respondents did not know that Medicare offers prescription drug coverage.

- 5% of Medicare-eligible* respondents did not know that Medicare offers prescription drug coverage.

Like any insurance plan, Medicare Part D does not cover all prescription drugs. Each Part D plan must cover at least two drugs from every drug category but it’s up to the plan to decide which two drugs they offer per category. For example, even if blood pressure medication is covered by Part D, your plan might only cover Prinivil and Zestril but not Norvasc.

- 19% of all respondents believe that Medicare Part D covers all prescription drugs.

- 18% of respondents who were reported they were familiar with Medicare Part D believe that it covers all prescription drugs.

- 14% of Medicare-eligible* respondents believe that Medicare Part D covers all prescription drugs.

Medicare Part D has a coverage gap, which is commonly referred to as the “donut hole.” Part D consumers move into different stages of coverage as they spend more money on covered drugs. First, the consumer is responsible for the full cost of prescriptions until they meet their deductible (if their plan has one). Next, the consumer and the plan split the cost of the drug (coinsurance rates vary by plan) until the consumer and plan have spent $4,660 altogether in 2023. Between $4,660 and $7,400, the consumer is in the coverage gap (or donut hole), which means they’ll pay 25% of drug costs. Nearly three-quarters of Americans did not know that this coverage gap stage is also referred to as the donut hole.

- 73% of all respondents did not know that Medicare Part D’s coverage gap is also commonly referred to as the donut hole.

- 41% of Medicare-eligible* respondents did not know that Medicare Part D’s coverage gap is also referred to as the donut hole.

- 37% of respondents who were reportedly familiar with Medicare Part D did not know that the coverage gap is also referred to as the donut hole.

Misconceptions about Medicare coverage

Medicare covers many health services but not everything and there are nuances between each part of Medicare. For example, Part B covers medications administered by a healthcare professional while Part D covers prescription drugs you take regularly at home.

Vaccine coverage is another confusing benefit. Part B covers flu shots, pneumonia shots, hepatitis B shots, and COVID-19 vaccines while Part D covers most other vaccinations. Unfortunately, nearly half of the respondents didn’t know flu shots were covered by Medicare at all.

- 49% of all respondents did not know that Medicare covers flu shots.

- 16% of Medicare-eligible* respondents did not know that Medicare covers flu shots.

Medicare coverage for COVID-related care is also unclear to more than half of respondents. Part A covers COVID-related hospitalizations. Part B covers telehealth or office visits, COVID tests, vaccines, and monoclonal antibody treatments. Part D covers prescription drugs that may be used for COVID treatments such as molnupiravir, Paxlovid, remdesivir, and dexamethasone unless administered while hospitalized.

- 52% of all respondents did not know that Medicare covers COVID tests, vaccines, and monoclonal antibody treatments.

- 22% of Medicare-eligible* respondents did not know that Medicare covers COVID tests, vaccines, and monoclonal antibody treatments.

Because Medicare is for seniors and people with certain disabilities or serious health conditions, many people expect Medicare to cover long-term care. However, it does not. Long-term care is defined by Medicare as “help with basic personal tasks of everyday life”, which it calls “custodial care”—not medical care.

Likewise, Medicare does not cover custodial care. This applies to residential care facilities such as senior assisted living centers, nursing homes, and most long-term in-home care. However, Part A may cover up to 100 days in a skilled nursing facility if it is deemed medically necessary. Part A and/or Part B may cover some home health services such as part-time skilled nursing care, physical therapy, and occupational therapy; however, Medicare does not cover 24-hour care at home, meals, or homemaker services.

- 31% of all respondents believe that Medicare covers long-term care.

- 23% of Medicare-eligible* respondents believe that Medicare covers long-term care.

- 34% of all respondents believe that Medicare covers care provided by an assisted living facility.

- 29% of Medicare-eligible* respondents believe that Medicare covers care provided by an assisted living facility.

- 27% of all respondents believe that Medicare covers long-term, in-home custodial care.

- 23% of Medicare-eligible* respondents believe that Medicare covers long-term, in-home custodial care.

Medicare is not free

Although more affordable than private health insurance, Medicare is by no means free. In fact, you’re already paying for Medicare before you even become eligible. Taxpayers pay a 2.9% Medicare tax on all earned income. Employers with W-2 employees pay 1.45% and the employee pays the rest. After becoming eligible, Medicare consumers will pay premiums, deductibles, and copayments or coinsurance just like any other insurance plan unless they are low income. What’s more? These costs typically increase year after year.

Not only does each part of Medicare (A, B, C, and D) have its own set of costs (premiums, deductibles, and copays), but certain parts (like Part C and D) have costs that can vary by plan and income too.

- 57% of all respondents did not know that Medicare premiums vary by part, plan, and income.

- 17% of Medicare-eligible* respondents did not know that Medicare premiums vary by part, plan, and income.

- 58% of all respondents did not know that there are different deductibles for each part of Medicare.

- 21% of Medicare-eligible* respondents did not know that there are different deductibles for each part of Medicare.

- 17% of all respondents believed that all Medicare Part D plans have the same premiums, deductibles, and copays.

- 12% of Medicare-eligible* respondents believed that all Medicare Part D plans have the same premiums, deductibles, and copays.

Will Medicare ever be expanded?

The last major extension of Medicare happened when Part D was created through The Medicare Prescription Drug Improvement and Modernization Act of 2003. Many presidential campaigns include Medicare reform as a talking point, including President Biden’s proposal to lower the Medicare age to 60 years old, but significant changes have been few and far between.

- 76% of all respondents believe that Medicare benefits should be expanded.

Do you believe Medicare benefits should be expanded? |

|

|---|---|

| Age group of respondents | % of age group that believe Medicare should be expanded |

| 18-24 years old | 62% |

| 25-34 years old | 70% |

| 35-44 years old | 73% |

| 45-54 years old | 74% |

| 55-64 years old | 86% |

| 65+ years old (Medicare-eligible* respondents) | 86% |

In 2018, 15% of the total federal spending budget was spent on Medicare. Medicare expansion would mean more government spending and higher taxes for high-income individuals. However, most survey respondents are onboard.

- Only 15% of all respondents believe that Medicare benefits should be decreased to reduce government spending.

- Only 5% of Medicare-eligible* respondents believe that Medicare benefits should be decreased to reduce government spending.

Our methodology

SingleCare conducted this Medicare survey online through AYTM on Jan. 7, 2022. This survey includes 1,500 United States adults ages 18+. Age and gender were census-balanced to match the U.S. population in age, gender, and U.S. region.

* Of the 1,500 adults we surveyed, 18% were 65 years or older and therefore eligible for Medicare. There is a chance that younger respondents were also eligible for Medicare, but this was not specified in the survey.