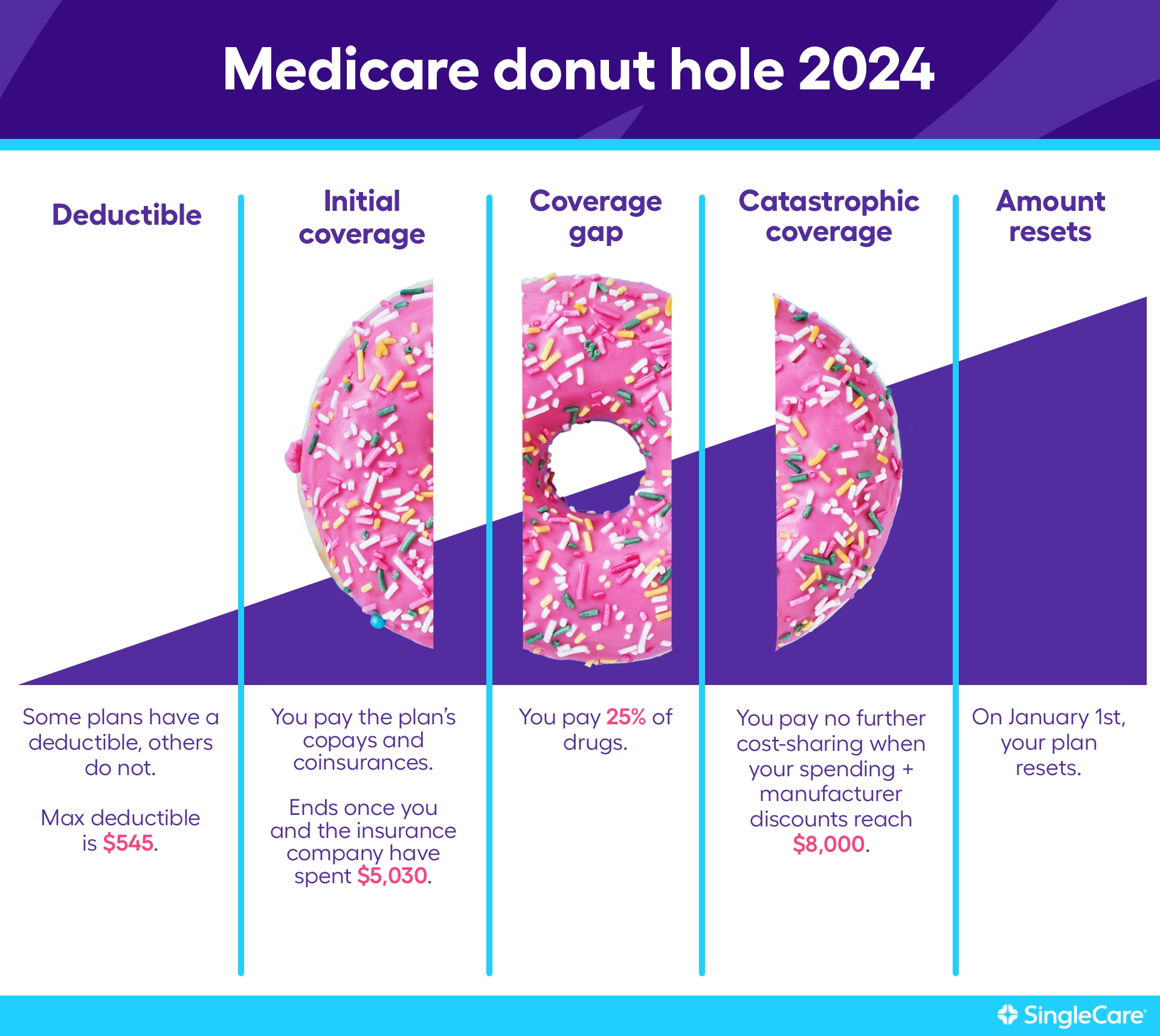

Donuts are great—they’re delicious and tasty treats. The donut hole, or the Medicare prescription drug coverage gap, which many people with Medicare fall into, is not great.

What’s the donut hole in Medicare?

So, what exactly is the Medicare donut hole?

“[The] donut hole used to be a much more noticeable feature of Part D plans before 2010,” says Maria Polyakova, Assistant Professor of Health Policy at Stanford School of Medicine and a Faculty Fellow at Stanford Institute for Economic Policy Research. “The idea was that once you [and your plan] reached a pre-specified amount of spending on your prescription drugs, you had to pay for 100% of your prescriptions until you reached another pre-specified amount.”

Today, the donut hole starts much later. You and your plan have to spend $5,030 in total on drugs in 2024 to get to the donut hole. And if you get there, you pay 25%, not 100%, for your prescriptions.”

You may be wondering why Medicare would have a donut hole at all. While the coverage gap has closed in past years thanks to the Affordable Care Act (ACA), it was intended as a way to keep the cost of the program down when first passed by Congress. Here is a breakdown of what you can expect in 2024 and what prices have been in previous years.

What is the Medicare Part D donut hole for 2024? |

|||

|---|---|---|---|

| Coverage stage | 2024 | 2023 | 2022 |

| Deductible | $0-$545 | $0-$505 | $0-$480 |

| Coverage starts after you reach your deductible | |||

| Initial coverage limit | You’ll reach the initial coverage limit when you and your plan pay… | ||

| $5,030 | $4,660 | 4,430 | |

| Coverage gap | You’ll pay 25% of drug costs until you and your plan spend … | ||

| $8,000 | $7,400 | $4,430 | |

| Catastrophic coverage | After you’ve spent $8,000, you pay no further cost-sharing | When your spending and manufacturer discounts reach $7,400, you’ll pay 5% for drugs or $4.15 for generics and $10.35 for brand-name drugs—whichever is greater | When your spending and manufacturer discounts reach $7,050, you’ll pay 5% for drugs or $3.70 for generics and $9.20 for brand-name drugs—whichever is greater |

Source: Medicare changes

Who is affected by the donut hole?

The federal government sets coverage phases for Medicare Part D consumers for how their drugs will be paid for throughout the year.

You enter the donut hole when the total cost of your prescription drugs reaches a predetermined combined cost. In 2024, that cost is $5,030. At this point, you will pay a percentage of medication costs (25% in 2024) while you’re in the Medicare donut hole.

The donut hole won’t affect all Medicare beneficiaries. If you have Original Medicare only (Parts A and B) and don’t have a Medicare prescription drug plan (Part D or a Medicare Advantage plan that includes Part D), the donut hole won’t affect you.

If you do have a Medicare prescription drug plan but total drug costs don’t reach $5,030 on covered medications, you won’t be affected by the donut hole.

Also, if you qualify for Extra Help, the donut hole won’t affect you.

If you find yourself in the Medicare donut hole and want out, you’ll need to hit your out-of-pocket threshold. Once you meet this cost, which is $8,000 in 2024, you will not have any further cost sharing. Specific costs are counted toward meeting this threshold that gets you out of the Medicare coverage gap.

Costs that count toward getting out of the coverage gap include:

- Your plan’s deductible.

- Copayments and coinsurance for your prescription drugs.

- Manufacturer discounts you may get from brand-name drugs during the donut hole period. To illustrate, if you have a manufacturer coupon for $50 off, this $50 will still be applied to your total paid costs.

- Whoever else (i.e., family, charities, etc.) who has paid on your behalf.

- Funds paid by state pharmaceutical assistance programs.

Costs that do not count toward getting out of the coverage gap include:

- Prescription drug costs that are not covered by your plan.

- The premium for your monthly Medicare prescription drug plan.

- Pharmacy dispensing fees.

RELATED: Medicare Part D costs

Medicare donut hole example

Let’s say you just signed up for Medicare Part D coverage and have paid your first month’s premium. First, you pay 100% of all covered drug expenses until you meet your deductible, which could be $0 to $545 in 2024.

Once you’ve reached your deductible, you’ll enter the initial coverage period. You’re then responsible for paying coinsurance or a copayment on the total cost of your covered prescriptions. Your Part D prescription drug plan will cover the rest. Copays and coinsurance vary by plan.

When your out-of-pocket costs and the costs incurred by your plan reach a combined total of $5,030, you enter the Medicare Part D donut hole. You will now be responsible for 25% of the costs of prescription drugs.

It’s easy to reach the donut hole because the $5,030 initial coverage limit includes your costs and your plan’s costs combined. It’s more difficult to get out of the donut hole because the $8,000 catastrophic coverage limit includes only what you have paid on covered drugs during the calendar year—not including your plan’s costs.

If your spending and manufacturer discounts reach $8,000, you’ll be out of the donut hole and in catastrophic coverage. Your plan will pay 100% of the cost of your medications as long as you are in the catastrophic coverage phase.

Coverage lasts the full calendar year and resets on Jan. 1 of every year. If you’re unhappy with your drug plan, you can make changes during the open enrollment period, which is Oct. 15 to Dec. 7.

To put it simply, the left side of the donut is the sweet part where you pay your deductible and coinsurance or a copayment. The donut hole is where you usually pay a higher percentage of your total drug costs. The right side of the donut is when you can enjoy lower drug costs again.

How to avoid the Medicare donut hole

There are several ways for Medicare Part D members to avoid falling into the donut hole.

1. Compare drug formularies before enrolling

Each Part D plan has its own drug formulary. Covered medications are placed on different tiers in the formulary. The cost of the drug increases for higher tiers. You’ll want to choose a plan with a formulary that includes most—if not all—of your medications and puts your medications on lower tiers. If possible, it’s also important to choose a plan with the fewest restrictions, such as prior approval or step therapy. Search medicare.gov if you need specific information on the medications that are covered by your Medicare program.

RELATED: What drugs are covered by Medicare Part D?

2. Choose generic drugs

Generic drugs are often significantly cheaper than brand names. If you can choose generic drugs over brand names, you’ll stay out of the donut hole longer by paying lower copays or coinsurance.

RELATED: Are generic drugs as good as brand-name medicines?

3. Extra Help

You can also apply for the Medicare Part D Extra Help program, designed to lower Part D costs for those who meet specific income and asset criteria. If qualified, you wouldn’t pay monthly premiums or deductibles up to a certain amount. You would be responsible for only a small copayment of each drug. Go to the Social Security Administration’s website at ssa.gov to learn more about the other potential benefits of applying for Extra Help.

4. Patient assistance programs

While Extra Help is helpful for many—not everyone qualifies. There are a couple of other options, including state pharmaceutical assistance programs and patient assistance programs through various nonprofit organizations and drug manufacturers.

5. SingleCare

Another option is SingleCare, which provides members with up to 80% off prescription medications. You can’t use SingleCare in conjunction with any Medicare plan. However, you can use SingleCare instead of Medicare in certain situations:

- Searching for your drug before going to the pharmacy to estimate your savings is easy. Sometimes, SingleCare offers prescriptions that cost less than Medicare.

- Medicare drug costs may also be higher than SingleCare prices during the donut hole. However, prescriptions purchased with SingleCare won’t count toward your coverage limit. Before the donut hole, using SingleCare will keep you away from the donut hole longer. But if you’re already in the donut hole, it’ll take you longer to get out of it. If you do not expect to spend more than $8,000 on medications, it may be worth using SingleCare for the lower copay and staying in the donut hole.

- Medicare Part D plans do not cover all drugs. Some medications like weight-loss drugs and erectile dysfunction medications will not be covered and, therefore, could be cheaper with SingleCare.

Sources

- Medicare.gov

- Extra Help with Medicare prescription drug plan costs, U.S. Social Security Administration

- State pharmaceutical assistance programs, Medicare Rights Center (2020)

- Prescription assistance, NeedyMeds