Key takeaways

BCBS may cover Mounjaro, but it all depends on the specific plan.

Some plans may list it as a preferred drug, while others list it as nonpreferred. Some might also have prior authorization requirements before they’ll cover it.

Without insurance or discounts, Mounjaro costs around $1,474 per month on average. Insurance can bring that price down, although many patients still have some out-of-pocket costs.

To check whether a BCBS plan covers Mounjaro, visit the website for your state, then find your plan’s formulary (aka drug list).

Aside from insurance, patients can save money on Mounjaro through prescription discount cards (like SingleCare), manufacturer discounts, comparing prices, and exploring alternatives.

Nationwide diabetes expenses topped $418 billion in 2022—and most of that money went to direct treatment, including medications like Mounjaro (tirzepatide), according to the American Diabetes Association. This injectable prescription drug mimics the hormones GIP and GLP-1, which stimulate insulin production, lowering blood sugar in individuals with Type 2 diabetes.

Many patients look to health insurance or Medicare for help with Mounjaro’s out-of-pocket price. And when it’s prescribed for diabetes, not weight loss, insurance often delivers. However, it depends on the provider and plan.

Does BCBS cover Mounjaro?

It’s difficult to make sweeping generalizations about insurance coverage since it’s highly complicated, and every health plan is different—even plans from the same provider. Plus, Blue Cross Blue Shield (BCBS) is actually a system made up of 33 local, independent licensees of the Blue Cross Blue Shield Association, and each of those companies has its own policies.

Therefore, some BCBS members may receive coverage for Mounjaro, while others might not. The only way to know for sure is to check the plan’s formulary, which is a list of drugs it covers. There are a few factors that might influence coverage, including the reason for taking it, whether you need prior authorization, and which tier the drug falls into.

Reason for taking it

Doctors may use Mounjaro to treat Type 2 diabetes or obesity, but insurance plans typically only cover it for diabetes, not as a weight loss medication.

However, Eli Lilly produces another tirzepatide drug called Zepbound. According to Alex Foxman, MD, physician and medical director for Achieve Health and Weight Loss, “Mounjaro is FDA approved for Type 2 diabetes mellitus, while Zepbound is FDA approved for obesity, but they are exactly the same medication with exactly the same dosing schedule.” Blue Cross Blue Shield may cover Zepbound for obesity treatment, but again, it all depends on the plan.

Prior authorization

Sometimes, a BCBS plan will cover Mounjaro, but only if the patient meets certain prior authorization (or pre-authorization) requirements. This can include a “documented diagnosis for Type 2 diabetes mellitus and a medical test confirmation, and the patient must be older than 18 years old,” says Sarah Bonza, MD, founder of Bonza Health. Some patients may even need to have their medical provider submit a prior authorization every year.

In her personal experience, Dr. Bonza says prior authorization has also meant her patients must have “persistently elevated A1C despite oral therapy.” On top of that, she says, “Sometimes it helps to have a comorbidity, particularly heart failure.”

Formulary tier

Plan formularies typically designate drugs as either preferred or non-preferred. They also organize these drugs into tiers—generics and preferred brands on the lower tiers and nonpreferred brands on the higher ones. The insurance company might cover certain brands on each tier, but drugs on their higher tiers typically have higher out-of-pocket costs, including copayments and coinsurance. Or, the company may request that the patient try a preferred option before it covers a nonpreferred one.

For example, Dr. Bonza says, “Ohio has Anthem Blue Cross Shield, and Mounjaro is Tier 2 and requires prior authorization.” Just remember that each BCBS company and plan has its own tier system, so while some might also put Mounjaro in tier 2, others might put it higher.

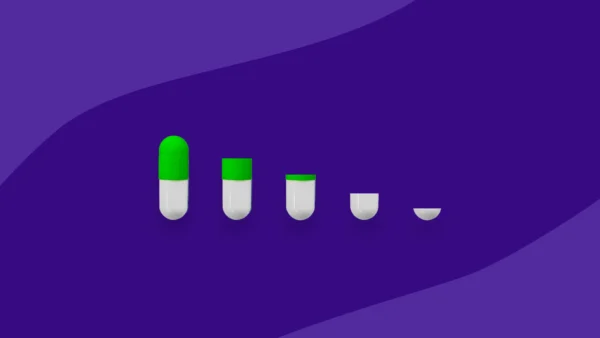

How much does Mounjaro cost?

Like many prescription drugs, without insurance coverage, Mounjaro isn’t cheap. Prices vary by pharmacy and location, but the average cost is $1,474 for a 30-day supply, which comprises four single-dose pens. That means a full year’s worth of Mounjaro could cost over $17,000 without insurance or assistance.

Copays are one of the main out-of-pocket costs for prescription drugs, and many BCBS plans have them. According to KFF’s 2022 employer health benefits survey, the average copay across insurance companies is $11 for first-tier drugs, $37 for second-tier drugs, $67 for third-tier drugs, and $116 for fourth-tier drugs. Many plans may put Mounjaro prescribed for diabetes in the second or third tier, although some put it higher.

How to check whether your BCBS plan covers Mounjaro

Mounjaro coverage depends on your specific insurance plan. Everything you need is in the plan’s formulary, a list that shows how the plan covers various generic and brand-name medications and which tier they’re on.

Because BCBS has so many independent licensees, it also has numerous formularies, each with its own tier system and requirements. If you log in to your plan online, you can access your formulary under “Resources” or “Benefits.” Once you have access to the formulary for your plan, scroll down to find Mounjaro.

Simply calling the company and asking is also an option. The representative will likely ask for information on your insurance card, such as your account and group numbers. Have that info handy when you call.

How to save on Mounjaro

No matter where it falls on the formulary, there are some effective ways to reduce Mounjaro’s cost. Here are a few of the most common.

- Get SingleCare discounts. Just present the SingleCare prescription drug discount card at a partner pharmacy, and it could take hundreds off the price of Mounjaro or other medications.

- Apply to the Mounjaro Savings Card Program. Mounjaro’s manufacturer, Eli Lilly, has a savings card that can help people with private insurance access the drug for as little as $25 per month. However, certain terms and conditions apply.

- Shop around. Every pharmacy sets its own prices, so Mounjaro might cost hundreds less at one than it does at another.

- Check your insurance. Be sure you know the details of your BCBS plan and what the out-of-pocket costs might be. If you’re denied coverage, find out why, since it can sometimes be due to easily fixable paperwork errors.

- Try a different medication. Even though other GLP-1 medications might not be cheaper, they could receive better coverage. “I am seeing Ozempic approval at a higher rate than Mounjaro, even though the cost of Ozempic is higher,” says Dr. Foxman. “I believe that as pharmacy benefit managers and insurance companies better understand the power of these medications and the likely long-term overall patient cost reduction due to better outcomes, these medications will be better covered.”

IMPORTANT: There have been reports of counterfeit doses of Mounjaro, Ozempic, and similar drugs. When searching for ways to make it more affordable, be wary of suspiciously underpriced medications. Always get your prescription from a doctor and the medication from a reputable pharmacy.

These methods might not work for everyone, but they’re fairly reliable ways to decrease the cost of Mounjaro and similar drugs. Asking a healthcare provider may also help since they can give personalized recommendations and resources for saving money.

Sources

- Statistics about diabetes, American Diabetes Association (2023)

- BCBS companies and licenses, Blue Cross Blue Shield

- FDA approves Lilly’s Mounjaro™ (tirzepatide) injection, the first and only GIP and GLP-1 receptor agonist for the treatment of adults with type 2 diabetes, PR Newswire (2022)

- 2022 Employer health benefits survey, KFF (2022)

- US: Counterfeit Ozempic, Wegovy, Mounjaro pens reported to FDA: How to spot a fake, National Association of Drug Diversion Investigators