Medicare Advantage plans are privately offered plans that bundle Medicare Part A (inpatient hospital insurance), Part B (outpatient medical insurance), and usually Part D (prescription drug coverage). If you’re familiar with Medicare Part D, then you know about the Part D coverage gap—also known as the “donut hole.” So, if your Medicare Advantage plan includes Part D, does the donut hole still apply?

RELATED: Medicare Part D vs. Medicare Advantage

What is the Medicare donut hole?

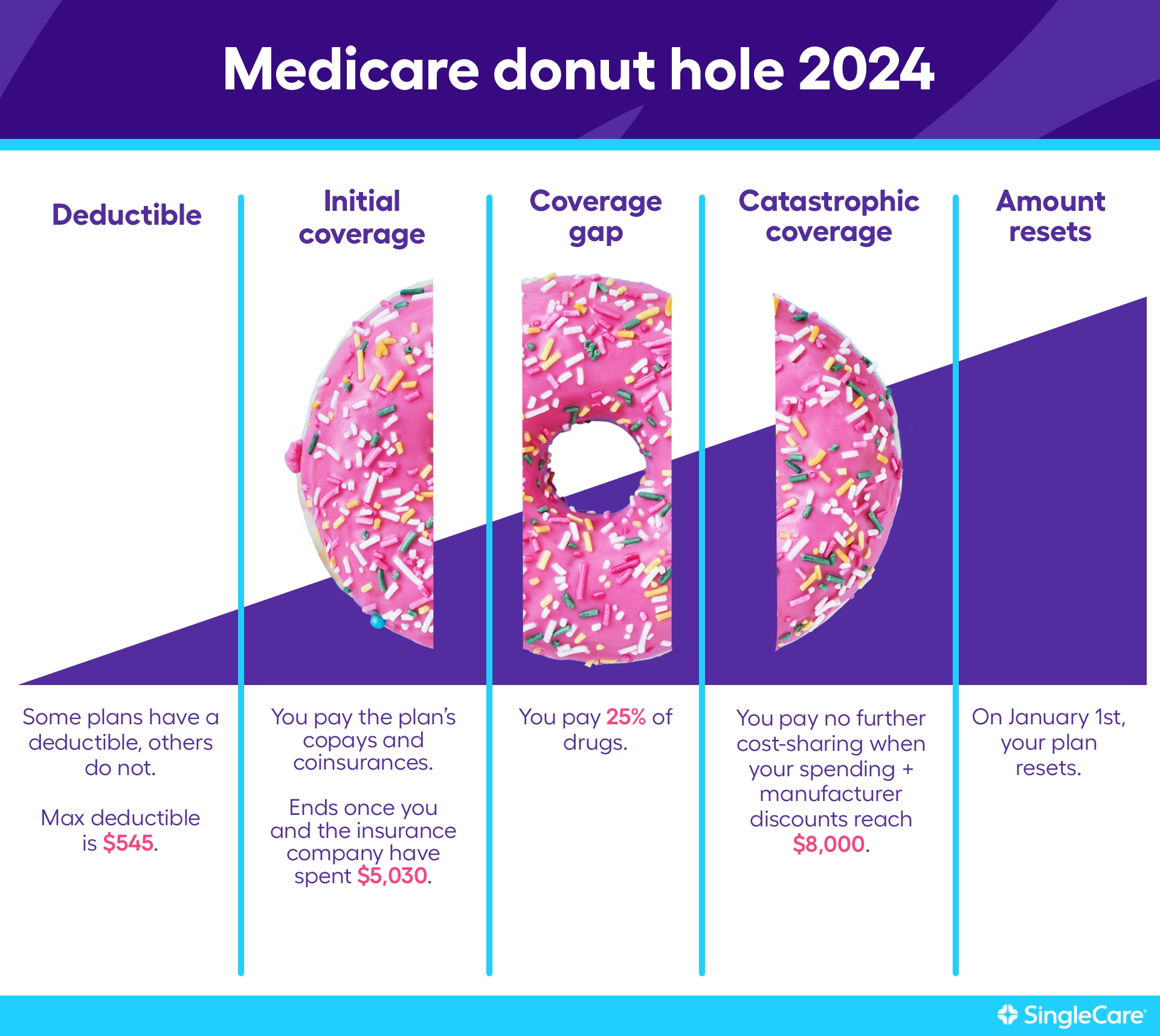

All Medicare Part D prescription drug plans have a coverage gap known as the “donut hole” that temporarily limits the amount of drug costs that are covered.

There are coverage phases for Medicare Part D beneficiaries during the calendar year determined by the federal government.

- Initial coverage stage: You’ll pay the full cost of your prescriptions until you meet your deductible.

- Coverage kicks in: You’re responsible for copayments on your prescriptions until the combined amount both you and your plan pay for medications for the year reaches $5,030.

- Donut hole or coverage gap: At this point, you will pay 25% of the cost of your prescriptions (generic drugs and brand-name drugs) until your total out-of-pocket costs for the year equal $8,000.

- Catastrophic coverage: After reaching a total out-of-pocket cost of $8,000 on covered drugs, you pay no further cost-sharing.

Does the donut hole apply to Medicare Advantage?

Some people ask: Do Medicare Advantage plans cover the donut hole? If you choose to include Medicare prescription drug coverage in your Medicare Advantage plan, it will still have a donut hole, just like a regular Part D plan. Medicare Advantage does not cover any additional Part D costs during the coverage gap.

RELATED: Drugs covered by Medicare

Is there any Medicare program that covers the Medicare Part D donut hole?

There is not a Medicare plan that covers the donut hole.

You may wonder if a Medigap could help you avoid donut hole costs. Medigap policies are private Medicare supplement insurance plans that are sold to cover additional costs and some services not traditionally covered by Original Medicare. But Medigap plans don’t include any drug coverage at all. Rather, you’ll need to get a standalone prescription drug plan, and therefore, the donut hole would still apply.

Your best bet to lower healthcare and prescription drug costs is to apply for additional savings opportunities, like Medicare Extra Help, the Senior Savings Model, and Medicare Savings Programs. Before enrolling in Medicare, review the covered prescription drugs under the formulary sections of different Medicare plans and choose the plan that covers the medications you take. Browse plans on medicare.gov.

RELATED: Medicare open enrollment

Additionally, you can follow these steps to save money while you’re in the Medicare donut hole:

- Compare prices at different pharmacies. If you search for your drug on singlecare.com, you’ll also be able to compare discounts at pharmacies near you.

- Look for manufacturer discounts, state pharmaceutical assistance programs, and patient assistance programs offered by various drug manufacturers and nonprofit organizations to help offset costs.

- Use a free SingleCare prescription discount card. Although SingleCare cannot be used in addition to any Medicare plan, you may choose to use SingleCare instead of Medicare in situations where SingleCare offers a better price on your prescription drugs. Before going to the pharmacy to pick up your prescriptions, visit SingleCare to see what your discount would be. Paying for drugs with SingleCare is a great way to lower costs while you’re in the donut hole. However, it’s important to note that any prescriptions you purchase using your SInglecare discount will not apply toward your Medicare Part D coverage limit.

Lea este artículo en español aquí.

Sources

- What’s Medicare Supplement Insurance (Medigap)?, medicare.gov

- Explore your Medicare coverage options, medicare.gov

- State Pharmaceutical Assistance Programs, Medicare Rights Center (2020)

- Prescription assistance, NeedyMeds (2020)