Key takeaways

High-deductible health insurance (HDHPs) plans have high deductibles but lower monthly premiums.

Preferred provider organization (PPOs) plans offer lower deductibles but higher monthly premiums.

Choosing the right healthcare plan depends on several factors, such as your health, finances, and number of dependents.

In general, HDHPs are better suited for people who are young, single, healthy, or wealthy.

PPO plans tend to be better options for people who are older, have a family, or have chronic medical conditions.

HDHP vs. PPO | HDHP pros and cons | PPO pros and cons | Which is better? | Cost comparison

Choosing the best employer-provided healthcare plan can be tricky. Two common health insurance options employers provide are the high deductible health plan (HDHP) and the preferred provider organization (PPO) plan. When choosing between an HDHP vs. PPO plan, what is best differs by individual, and it may even vary year-to-year for a person based on his or her circumstances, financial goals, and healthcare costs.

HDHP vs. PPO

What is an HDHP?

A high-deductible health plan (HDHP) is a type of health insurance plan with higher deductibles but lower premiums. A deductible describes out-of-pocket costs for health services with a predefined maximum; after that maximum is reached, insurance coverage kicks in. A premium is what you pay monthly for your healthcare coverage.

With an HDHP, you will pay lower premiums but more out-of-pocket for medical expenses before your insurance begins to pay for care.

What is a PPO?

A preferred provider organization (PPO) plan comes with lower deductibles but higher monthly premiums. With a PPO, you pay more money each month but have lower out-of-pocket costs for medical services.

“HDHPs typically benefit healthier consumers who do not expect to need much medical attention for the year, and the advantages include lower monthly premiums,” explains Susan Beaton, a former VP of provider services at Blue Cross and Blue Shield of Nebraska.”A PPO, especially one with a low deductible, may suit those who expect frequent doctor visits and prescriptions due to something like a chronic condition.”

HDHP pros and cons

An HDHP may be better suited for those who do not anticipate having many medical expenses throughout the coming year. Typically, HDHPs cover routine preventive care, so they are a good option for younger people, individuals without families, and those generally healthy.

When you choose an HDHP, you are eligible to contribute to a health savings account (HSA). An HSA is a pre-tax savings account for eligible medical expenses such as vision care, dental care, and prescription drugs. The tax-free money in this savings account rolls over year-to-year, although an annual max contribution differs between individual and family plans. An HSA is especially advantageous because it uses pre-tax dollars and accrues tax-free earnings. Your HSA funds will also stay with you even if you change health care plans or move jobs, and they can also be shared with your family.

Nevertheless, if you use your HSA for non-qualified expenses before the age of 65, you will be faced with taxes plus a 20% penalty. Some HSAs may also charge fees for transactions or account maintenance.

PPO pros and cons

PPOs are usually a better choice for those who anticipate having more medical bills throughout the year due to health needs. These plans are typically beneficial for older people, those with family members, and people with health conditions that require treatment on a regular basis.

As you age, encounter health issues, or support a family, a PPO may make more sense. PPOs come with higher premiums, but they can be the right plan in the long run if you utilize healthcare services more regularly.

You wouldn’t be eligible for an HSA with an employer-sponsored PPO plan, although you may be able to use flexible spending accounts (FSA).

PPOs also come with added flexibility advantages over a more traditional health plan, like a Point of Service (POS) plan. POS plans allow participants to pay lower costs for network care, but require your primary care physician to write referrals to see specialists. On a PPO plan, you have the freedom to choose the doctor or hospital of your choice. Even if they aren’t in your network, your insurance frequently will still offer coverage. PPOs also allow you to see a specialist or have a procedure or test done without a referral from your primary care provider. If flexibility in your healthcare choices is important to you, a PPO plan may be a better choice than an HDHP.

Is an HDHP or PPO better?

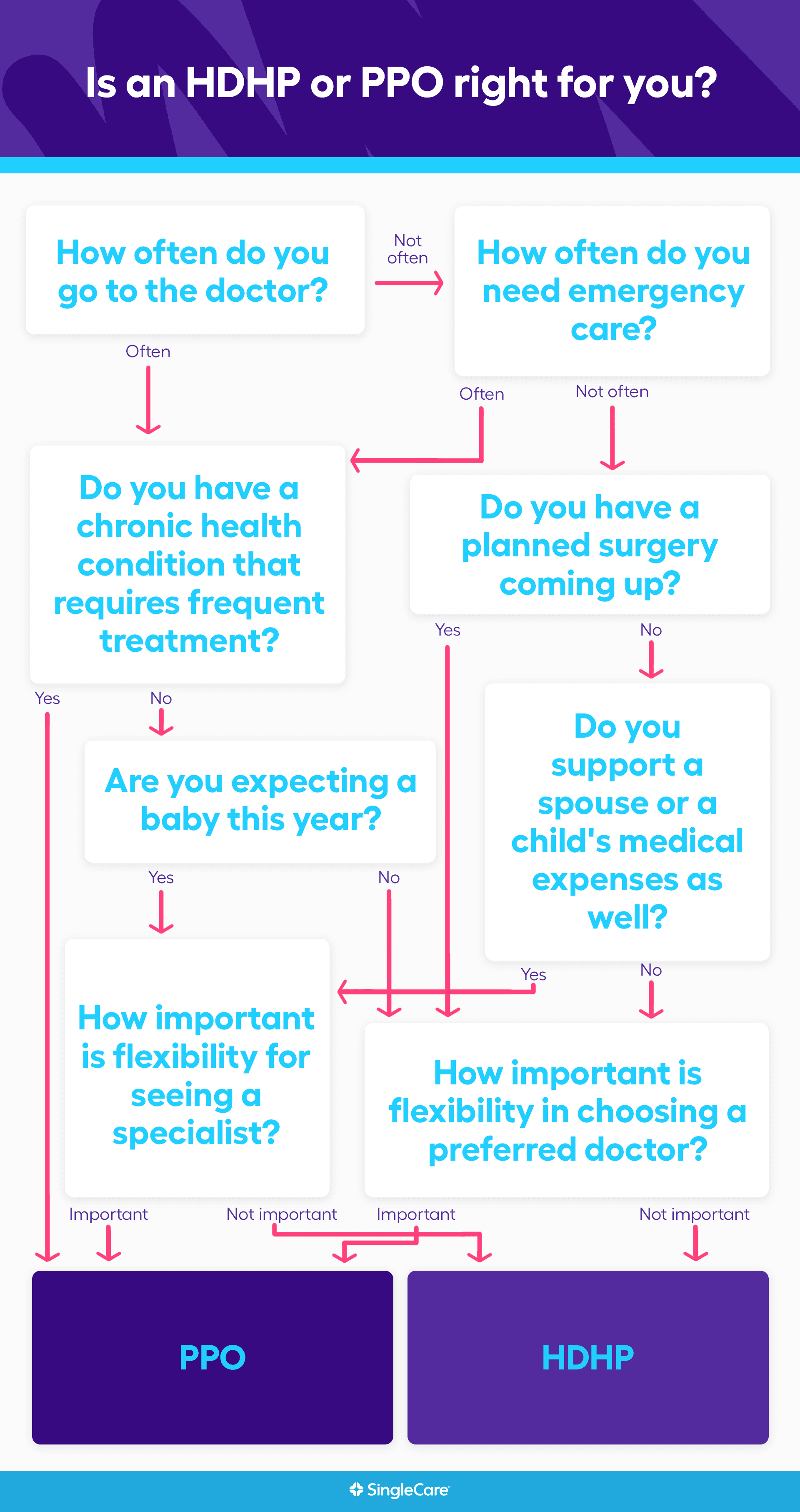

Now, we’ll review how you decide whether an HDHP or PPO plan would be better for you. First, consider the following questions:

- How often do you go to the doctor?

- Do you have a chronic health condition that requires frequent treatment?

- How often do you need emergency care?

- Do you have a planned surgery coming up?

- Are you expecting a baby this year?

- Do you support a spouse or a child’s medical expenses as well?

- How important is flexibility in choosing a preferred doctor?

- How important is flexibility when seeing a specialist?

If you frequently visit the doctor, have a chronic condition, often seek emergency care, have planned surgery, are pregnant, support multiple family members’ medical expenses, or care about flexibility, a PPO may be better than an HDHP from a financial standpoint. However, if none or a few of these considerations matter to you, you will likely be better suited with an HDHP.

Note: HDHP and PPO plans are not your only health insurance options. There are also Health Maintenance Organizations (HMOs), Exclusive Provider Organizations (EPO), and Point of Service plans (POS).

RELATED: HMO vs. PPO

Comparing costs between HDHPs and PPOs

When deciding between the two, estimate your annual medical expenses first. A healthy individual may not have many estimated expenses but could consider the possibility of catching the flu or sustaining an injury if they are a fairly active person.

Once you estimate your medical expenses, review each plan’s monthly premium plus their respective out-of-pocket limits.

Next, make sure you understand the key terms associated with each of these health insurance plans.

- Premium: How much you pay each month to have health insurance.

- Deductible: How much you have to pay upfront annually for medical care before your insurance starts to pay for care. Once you meet your deductible, health insurance coverage kicks in.

- Out-of-pocket limit: After spending this amount in a year for medical care out-of-pocket (not including premiums), your insurance will pay for 100% of eligible expenses.

- HSA: A pre-tax health savings account that can be used with an HDHP. HSA contributions roll over annually.

- FSA: A pre-tax flexible spending account that you can use for certain out-of-pocket healthcare costs. It cannot be used if you have an HSA, and typically, the contributions do not roll over.

- Copay: A flat fee you pay for prescriptions, check-ups, and other healthcare services.

- Coinsurance: The percentage of costs you pay for covered medical expenses after you meet your deductible.

HDHP vs. PPO cost examples

For example, a PPO plan may charge a $1,250 deductible with a monthly premium of $600. After multiplying the monthly premium for 12 months ($600 x 12) and adding the deductible for out-of-pocket costs, this amounts to a total of $8,450 annually, not including copays or coinsurance.

An HDHP may charge a $3,000 deductible with a monthly premium of $400. After multiplying the monthly premium for 12 months ($400 x 12) and adding the deductible for out-of-pocket costs, this amounts to a total of $7,800 annually.

In the second example, you pay $200 less each month on the premium and save $650 on annual healthcare costs, not including copays or coinsurance.

“If you find that the out-of-pocket cost for the HDHP is lower than the PPO option, it seems as though the smart choice would be to choose the HDHP,” Beaton says. “However, before making this choice, be sure your budget can handle it. Will you be able to pay $250 for an office visit on the day of your visit, or $800 at the emergency room and so on, until your deductible is met? If your current budget does not have room to cover the higher costs at the time of service, you need to think twice before choosing the HDHP plan.”

Choosing a health insurance plan is a highly individualized decision that requires weighing many factors, including:

- Your state of health

- Your family’s health

- Flexibility preferences for healthcare providers or specialists

- Your financial situation

- Whether you can pay more upfront with premiums for more coverage

- How much HSA funds you can use

- The out-of-pocket spending cap on each policy

Sources

- Announcing 2024 IRS HDHP and HSA limits, UnitedHealthcare (2023)

- Choosing your health insurance plan: HMO vs. PPO vs. HDHP, University of Florida (2021)

- PPO or HDHP? Choosing the healthcare plan that’s right for you, Baylor University (2017)

- Understanding health insurance plans, National Institute of Health (2022)