Key takeaways

Medicare may cover Mounjaro for Type 2 diabetes if it’s on the plan’s formulary, but it will not cover it when prescribed solely for weight loss.

Out-of-pocket costs for Mounjaro can be high, but Medicare coverage, copays, deductibles, and new $2,100 annual drug cost caps can help lower expenses.

Patients can save through SingleCare coupons, Medicare Extra Help, Medicaid, manufacturer programs, 90-day prescriptions, and alternative GLP-1 drugs.

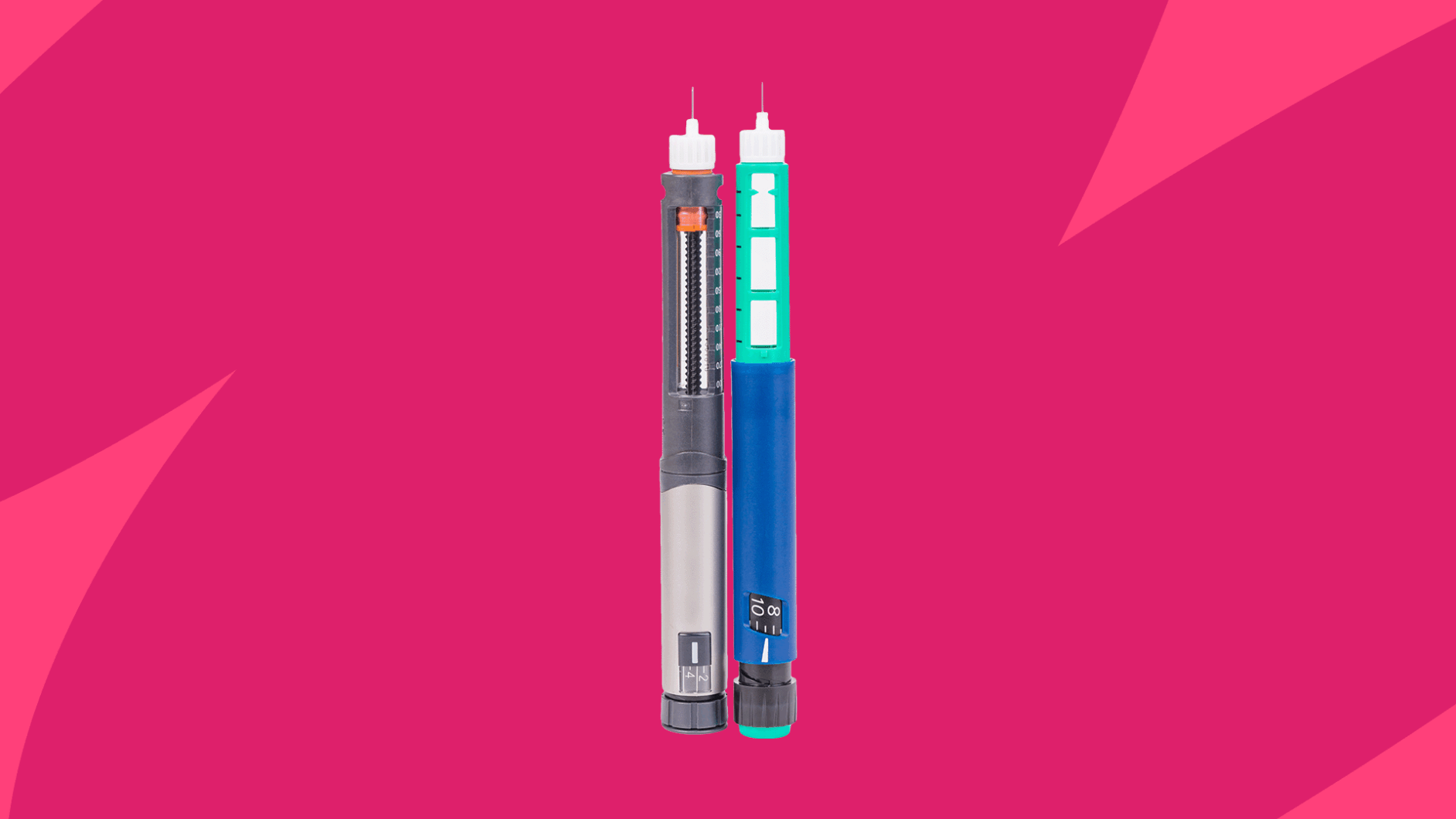

Type 2 diabetes and obesity are two of the most prevalent health issues in the U.S., so if you’ve got a drug that can treat both, it’s bound to be popular. That’s Mounjaro (tirzepatide) and other GLP-1 analogs. Mounjaro is only FDA-approved for Type 2 diabetes, but it’s also helped many people lose weight, and some healthcare providers may prescribe it off-label for weight management. Either way, one glance at its average out-of-pocket costs might leave you wondering how, besides your Medicare plan, you might be able to save money. Here are some useful tips.

Save up to 80% on Mounjaro with SingleCare

Different pharmacies offer different prices for the same medication. SingleCare helps find the best price for you.

Does Medicare cover Mounjaro?

Sometimes, but not always. It largely depends on why the healthcare provider has prescribed it. “Medicare may cover Mounjaro when it’s prescribed to treat Type 2 diabetes and the drug is on the plan’s formulary,” says Dr. Afi Semenya, MD, a physician at Boston Medical Center (BMC) and Mochi Health. “It is also important to note that Medicare does not cover Mounjaro when it’s prescribed solely for weight loss.” Eli Lilly (Moujaro’s manufacturer) has developed a tirzepatide drug specifically approved for weight loss—called Zepbound—but Medicare typically won’t cover it for that purpose.

Some Medicare health insurance plans might list Mounjaro as a “non-preferred brand,” which means they’re more likely to cover other options. For these plans, you may need prior authorization. This is the process by which insurance companies confirm that a specific prescription drug is medically necessary. It may require the prescriber to submit additional documentation, or it might require step therapy—trying other drugs first before moving to Mounjaro.

How much does Mounjaro cost with Medicare?

If you were to pay for Mounjaro completely out of pocket, you could pay around $1,504 for 4, 5mg/0.5ml 0.5ml pens—a 30-day supply. However, you likely won’t pay that much if you have Medicare coverage.

Since every Medicare Part D plan differs, it’s difficult to pinpoint exactly how much you’ll pay after Medicare covers its portion. However, in 2023, Medicare contributed over $2 billion to 370,203 beneficiaries for their Mounjaro prescriptions. That’s around $6,379 per beneficiary.

You may have to pay the full amount until you reach your deductible, which can vary by plan. However, the limit for Medicare Part D deductibles is $615. After that, you’ll pay 25% coinsurance. Between the deductible and copays, the federal government has capped 2026 out-of-pocket drug costs at $2,100 for all Medicare beneficiaries.

Mounjaro assistance for Medicare patients

Even with Medicare coverage, sometimes Mounjaro can still be expensive. Whether you don’t receive coverage from your Medicare plan or need help paying your deductible or coinsurance, there are reliable ways to save. “Patients can therefore lower costs by choosing a Part D plan that covers Mounjaro, making sure prior authorization is completed, and asking about a tier exception when appropriate,” says Dr. Semenya. “But this again depends on individual plans.” Here are a few other ways:

Free Mounjaro coupons

SingleCare coupons can immediately knock hundreds off the price of Mounjaro—$875 instead of the typical $1504 out-of-pocket cost. All you have to do is sign up, then present your SingleCare coupon card at any participating pharmacy. You can use SingleCare even if you have Medicare Part D, but you can’t use the coupons on top of your Medicare coverage. You’ll have to see which option will save more money.

Medicare Extra Help

This is a program for Medicare beneficiaries who need assistance paying their Medicare prescription drug coverage (Part D) premiums, deductibles, coinsurance, and other costs. To qualify as an individual, you can’t earn more than $23,475 per year or have more than $18,090 in resources (stocks, bonds, etc.). For married couples, those numbers go up to $31,725 and $36,100, respectively. People who qualify for Extra Help will have a $0 deductible and’ll only pay up to $12.65 for each brand-name drug.

Medicaid

Medicaid is another government program funded by both state and federal governments that provides financial assistance for people who need help paying their medical and prescription drug costs. Each state sets its own eligibility requirements, but there’s typically an income limit to qualify. Any Medicare beneficiaries who enroll in Medicaid will also automatically receive Extra Help benefits.

Manufacturer assistance programs

Eli Lilly has a Mounjaro savings card, and they say eligible enrollees will pay as little as $25 per prescription. However, you can’t qualify for this card if you’re enrolled in Medicare Part D, Medicaid, or any other government-funded prescription assistance program. The company also has a patient assistance program called Lilly Cares, and even though it doesn’t currently apply to Mounjaro, it’s worth keeping an eye on in case they add it in the future.

90-day prescriptions

If your insurance plan and healthcare provider allow it, you can save some money by getting a 90-day prescription instead of a one-month supply. “Opting to buy the 90-day (3-month) option can also help lower costs and is convenient for those who plan to use Mounjaro for the long term,” says Dr. Semenya. In fact, a study from the Medicare & Medicaid Research Review found that patients who got 90-day prescriptions not only saved money, but also had better medication adherence and persistence with minimal medication waste.

Free samples

Some healthcare professionals may stock free samples for their patients. And while this might be a good way to get a few doses for free, it’s not a long-term solution for saving money.

Alternative medications

Mounjaro isn’t the only GLP-1 drug available, and some others might have better prices or insurance coverage. In 2024, the FDA approved the first GLP-1 generics. A generic version of liraglutide only costs around $341, or $108 with SingleCare coupons. Besides that, Ozempic, Rybelsus, and Victoza are all GLP-1 drugs and brand-name Mounjaro alternatives. These might not be less expensive, but some Medicare plans may prefer them. Additionally, metformin, glipizide, and sitagliptin are common prescription medications for managing blood sugar levels.

- How do drug plans work, Medicare.gov

- Mounjaro label, DailyMed

- Medicare Part D spending by drug, Centers for Medicare & Medicaid Services (2023)

- How much does Medicare drug coverage cost?, Medicare.gov

- Help with drug costs, Medicare.gov

- State overviews, Medicaid.gov

- Medication days’ supply, adherence, wastage, and cost among chronic patients in Medicaid, Medicare & Medicaid Research Review (2012)

- FDA approves first generic of once-daily GLP-1 injection to lower blood sugar in patients with Type 2 diabetes, U.S. Food and Drug Administration (2024)