Key takeaways

Some employer-based insurance companies and marketplace insurance plans cover Zepbound, but it differs widely from one insurance company to another.

Medicare and Medicaid don’t generally cover Zepbound for weight loss only, but are more likely to cover it if you are using it to treat another coexisting medical condition, like obstructive sleep apnea or Type 2 diabetes.

Even when insurance covers Zepbound, you might have to pay out-of-pocket costs like copays and deductibles.

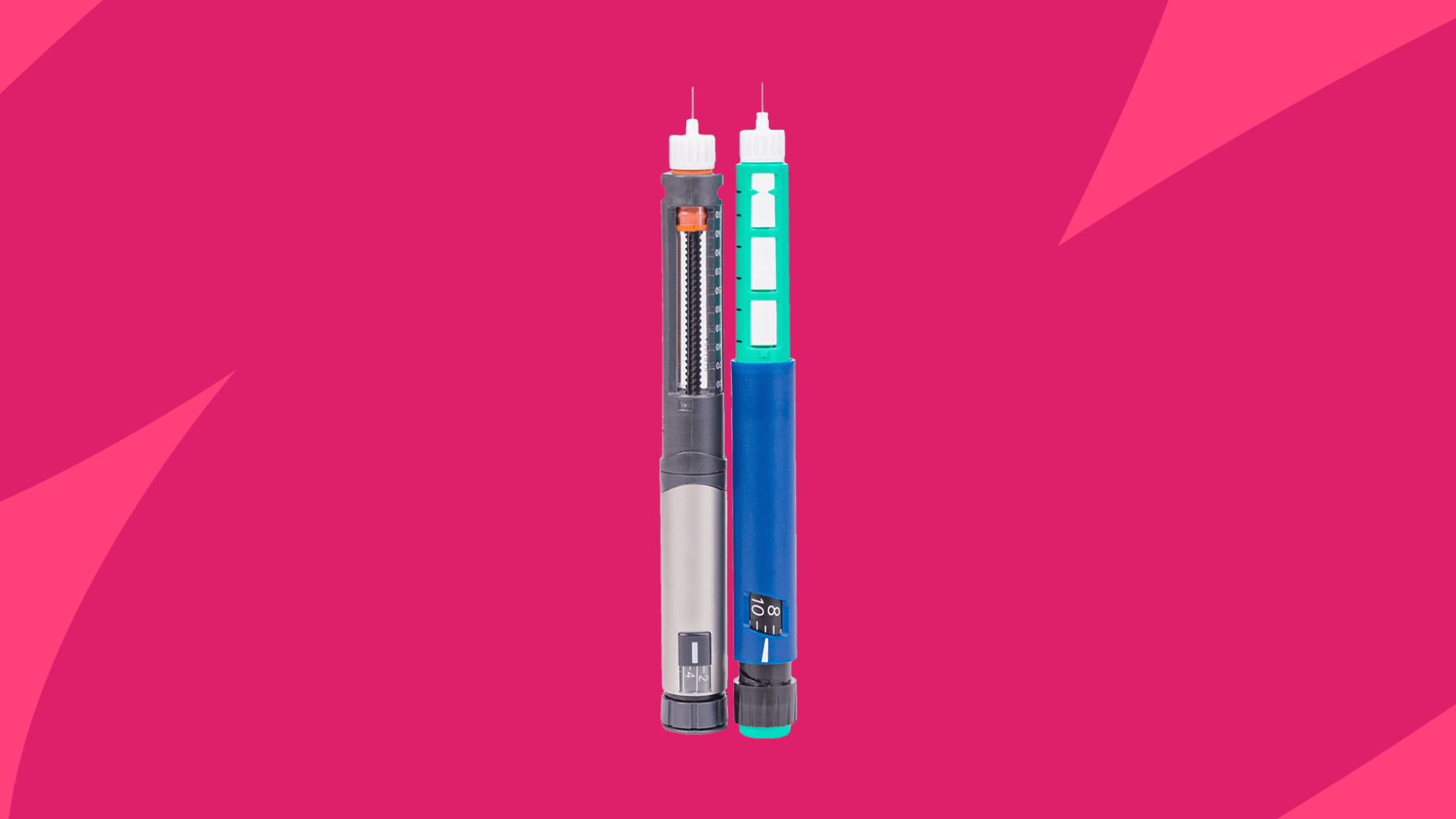

Zepbound is the brand name of tirzepatide, a dual GLP-1/GIP receptor agonist that’s FDA-approved for weight loss in adults with obesity or who are overweight with at least one weight-related health condition. Zepbound is also approved to treat severe obstructive sleep apnea (OSA) in obese adults. Administered as a once-weekly injection, Zepbound is intended for use in conjunction with a balanced diet and regular physical activity to achieve weight loss goals.

If you were prescribed Zepbound or considering taking it, you might be wondering: Is Zepbound covered by insurance? The answer is that insurance coverage depends on several factors, including what type of insurance you have and what your reason is for taking Zepbound.

Save up to 80% on Zepbound with SingleCare

Different pharmacies offer different prices for the same medication. SingleCare helps find the best price for you.

Does insurance cover Zepbound?

Zepbound can be very expensive, which is why so many users want to know if Zepbound is covered by insurance.

The good news is that some insurance companies do cover Zepbound, but it really depends on your specific insurance plan. Other factors that come into play include the condition for which you are taking the medication.

“Some private insurance companies do cover it, but usually only for certain approved conditions – like when it’s prescribed for obesity with other health concerns, or for diabetes,” says Linda Khoshaba, NMD, FABNE, board-certified in naturopathic endocrinology and founder of Natural Endocrinology Specialists (NES).

Even when an insurance company covers Zepbound, there are often some hoops to jump through to get your coverage approved. “They often require prior authorization, meaning your doctor has to submit paperwork proving medical necessity,” Dr. Khoshaba says. “Some plans may also make you try other treatments first (known as ‘step therapy’).”

Part of the reason why Zepbound drug coverage varies significantly is that insurance coverage for weight loss medication is complex and exists in a somewhat gray area. “They’re expensive, and historically, weight management hasn’t been treated like other chronic health conditions,” Dr. Khoshaba explains. “Add in evolving research, new approvals, and differing views on what’s ‘medically necessary,’ and you end up with a lot of red tape.”

Another factor to consider is that there is currently no generic version of Zepbound. Sometimes, insurance companies will cover a generic version of a prescription drug, rather than a brand-name version, because generics are typically less expensive than brand-name drugs. But with Zepbound, there is currently no generic available, which means insurance companies are typically more reluctant to pay the high cost of the drug.

Commercial insurance

When it comes to commercial insurance (e.g., employer-based insurance or private insurance), coverage for Zepbound may vary depending on the specific requirements of the employer. “When an employer purchases a health insurance plan for their employees, they can opt in or opt out of the coverage of medications for the treatment of obesity,” explains Sarah Stombaugh, MD, an obesity medicine physician. “Especially for smaller employers, including these benefits can be incredibly costly, so it often is not included as part of the health insurance benefit.”

Marketplace plans

There are also variations in coverage for Marketplace insurance plans – i.e., government-sponsored plans established by the Affordable Care Act (ACA). A 2024 analysis from KFF, a nonprofit health policy research group, found that Marketplace plans rarely cover GLP-1 drugs, such as Zepbound, Wegovy, Mounjaro, or Ozempic, when prescribed solely for weight loss. Additionally, these plans typically require stipulations, such as prior authorization or quantity limits, before covering the drugs. Marketplace coverage may vary from one state to another, so you should contact your specific plan if you have questions about Zepbound coverage.

How much does Zepbound cost with insurance?

Even when Zepbound is covered by insurance, you can expect to have some out-of-pocket costs. “Copays and coinsurance can vary a lot depending on your plan,” Dr. Khoshaba says. “Some people pay a standard specialty-drug copay, while others might have higher costs if their plan uses percentage-based pricing.”

Your copay and out-of-pocket costs may depend on the tier your insurance company assigns to Zepbound. Usually, drugs in tier 1 have the lowest copayment, whereas drugs in tier 3 or above typically have the highest copayment. Zepbound’s tier can vary, but it’s usually in a higher tier than other drugs.

Overall, the out-of-pocket costs for Zepbound vary widely. “I have patients with a $0 copay and those who have to meet their healthcare deductible before they see any coverage toward the medications,” Dr. Stombaugh says. Eli Lilly, Zepbound’s manufacturer, states that Zepbound can cost as little as $25 with insurance, providing a one- to three-month supply.

How much does Zepbound cost without insurance?

The cost of Zepbound without insurance tends to be on the high side. For example, Zepbound costs more than $1500 for a month’s worth of injections, or four injections to be taken weekly. Each of these injections is about $375. Overall, without insurance coverage, you can expect Zepbound to cost a little over $19,000 per year.

Does Medicare or Medicaid cover Zepbound?

Unfortunately, Medicare and Medicaid tend not to cover weight loss drugs, especially if they’re only prescribed for weight loss.

Medicare

Medicare provides insurance to adults aged 65 and up and certain individuals with disabilities. According to Dr. Stombaugh, Medicare doesn’t cover medications used solely for weight loss. “At this time, Medicare does not cover Zepbound for the treatment of weight reduction, but they may cover it for the treatment of moderate to severe sleep apnea in adults with a BMI of 30 or higher,” Dr. Stombaugh shares.

Medicaid

Medicaid, which is insurance for low-income individuals, also typically doesn’t cover weight loss medications. But this can vary from one state to another. “Some states do cover it, but with strict approval criteria and prior authorization,” Dr. Khoshaba says. “It really depends on where you live and which plan you’re on.”

Ways to save on Zepbound

If your insurance doesn’t cover Zepbound, there are options out there to help you save. Here are some options to consider.

1. SingleCare savings card

SingleCare savings coupons are free to use and can help you save money when you purchase Zepbound without insurance. Simply present your SingleCare card at the pharmacy when checking out. With a SingleCare savings card, Zepbound costs $949.89 for 4, 5mg/0.5ml 0.5ml pens.

2. Contact your insurance company

If your insurance provider denies coverage for Zepbound, it’s always worth contacting them to discuss options, including appealing the denial of coverage. “Sometimes appealing a denial with supporting documentation — like your BMI, medical history, and past treatments — can also lead to approval on a second try,” Dr. Khoshaba says. You can ask your healthcare provider to collaborate on a plan to provide documentation to your insurance plan.

3. Contact the drug manufacturer

Zepbound’s manufacturer, Eli Lilly, offers savings programs for individuals without insurance coverage. For example, Eli Lilly offers a self-pay option for single-dose vials of Zepbound. If eligible for the program, you can pay $349 per month for four vials of 2.5 mg of Zepbound or $499 for four vials of 5 mg or higher.

- Label: zepbound– tirzepatide injection, solution

- zepbound– tirzepatide injection, solution, DailyMed (2025)

- Costly gLP-1 drugs are rarely covered for weight loss by marketplace plans, KFF (2024)

- How do drug plans work?, Medicare.gov

- How much should I expect to pay for Zepbound (tirzepatide)?, Eli Lilly (2025)

- Ways to save—regardless of your insurance status, Eli Lilly (2025)