Is Janumet covered by insurance? | How much does Janumet cost without insurance? | How to get Janumet without insurance

Janumet is a brand-name prescription drug that combines two diabetes medications: metformin and sitagliptin. They are both FDA-approved to control blood sugar levels in people with Type 2 diabetes but are inappropriate for Type 1 diabetes. As an antidiabetic drug, low-priced metformin is commonly prescribed as a first-line treatment to lower blood sugar. Sitagliptin is a newer drug and can only be purchased in premium-priced brand name versions: Janumet, extended-release Janumet XR, Januvia (sitagliptin), and Steglujan (ertugliflozin and sitagliptin). Health insurance can help defray some of the cost, but those without insurance coverage also have ways to save money.

Related: Janumet side effects

What is the generic for Janumet?

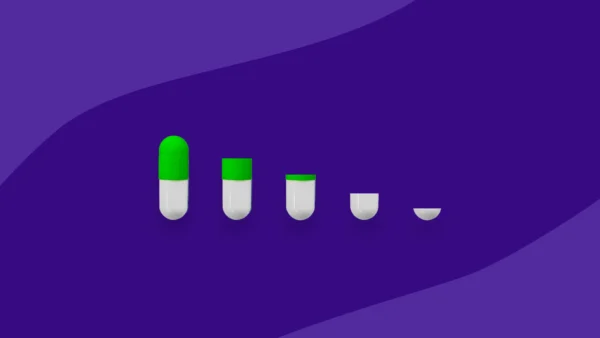

Janumet is a combination drug containing the antidiabetic drugs metformin and sitagliptin. Metformin is a widely prescribed and low-priced generic drug. Sitagliptin, however, is only available in brand-name products manufactured by Merck & Co. A generic version of sitagliptin may be available as early as 2026 or as late as 2029.

Is Janumet covered by insurance?

Many health insurance and Medicare Part D drug coverage plans cover a Janumet or Janumet XR prescription, including major insurers such as Aetna, Cigna, and Kaiser Permanente. Medicaid coverage varies by state. Insurance companies tend to place Janumet and Janumet XR in their higher copay tiers. So, people with coverage should expect to pay more for a Janumet prescription than for generic drugs. The out-of-pocket cost will also be influenced by other insurance plan terms such as deductibles, coinsurance, or coverage gaps.

How much does Janumet cost without insurance?

As a brand-name drug, Janumet costs about $720 for 60, 50 mg/1000 mg tablets at the full retail price. With twice-daily dosing, 60 tablets is enough medicine for a 30-day supply. Extended to a full year of refills, Janumet therapy could cost almost $9,000 for people without health insurance coverage.

Janumet contains two antidiabetic medications that control high blood sugar. Metformin is available as a lower-priced generic drug. On the other hand, sitagliptin belongs to a newer family of oral antidiabetic drugs called DPP-4 inhibitors. Unfortunately, switching to another similar DPP-4 inhibitor combination will not save money for people without health insurance. Tradjenta (linagliptin) costs about the same as Janumet. Onglyza (saxagliptin-metformin) or Nesina (alogliptin) cost about $200 less per month than Janumet.

If budgeting for Janumet is challenging, ask the prescribing healthcare provider about other blood glucose-lowering drugs, including metformin, sulfonylureas, thiazolidinediones, starch-blockers, and meglitinides. The effectiveness and side effects will vary, so your provider can help find the medications that are right for you.

Another way to save money on Janumet is to use a SingleCare prescription discount card. The lowest discount price for Janumet is $370 for a 30-day supply and $1,200 for a 90-day supply.

RELATED: Janumet alternatives: What can I take instead of Janumet?

Compare Janumet prices to related drugs |

|||

|---|---|---|---|

| Drug name | Price without insurance of brand-name drug | SingleCare price | Savings options |

| Janumet | $728 per 60, 50 mg/ 1000 mg tablets | $368 60, 50 mg/ 1000 mg tablets of brand-name Janumet | See latest prices |

| Jardiance

(empagliflozin) |

$813 per 30, 25 mg tablets | $354 per 30, 25 mg tablets of brand-name Jardiance | See latest prices |

| Rybelsus | $1274 per 30, 7 mg tablets | $807 per 30, 7 mg tablets of brand-name Rybelsus | See latest prices |

| Xigduo XR | $770 per 60, 5-1000 mg tablets | $428 per 60, 5-1000 mg tablets of brand-name Xigduo XR | See latest prices |

| Steglujan

(ertugliflozin-sitagliptin) |

$710 per 30 tablets | $542 per 30 tablets of brand-name Steglujan | See latest prices |

Prescription drug prices often change. These are the most accurate medication prices at the time of publishing. The listed price without insurance references the price of brand-name drugs (unless otherwise specified). The listed SingleCare price references the price of generic drugs if available. Click the link under “Savings options” to see the latest drug prices.

How to get Janumet without insurance

At an annual cost of $9,000, Janumet treatment may be challenging for people without health insurance coverage. The manufacturer offers a patient assistance program, but not everyone can meet the strict eligibility requirements. Without patient assistance or manufacturer coupons, are there other ways to reduce the cost of Janumet? There are, and the first place to start is with a SingleCare prescription discount card.

1. Use a free coupon from SingleCare at a participating local pharmacy

With a SingleCare savings card, people can buy a 30-day supply of Janumet for as little as $370, saving $350 off the average retail price. Discount prices will vary by participating pharmacy, so browse available savings at local pharmacies on SingleCare’s Janumet coupons page. Then use SingleCare’s pharmacy finder to find the nearest location.

2. Shop around for the lowest price

Pharmacies charge different prices for the same prescription drug, but shopping for the best price will involve a lot of phone calls. The easiest way to shop for the best price is to use SingleCare’s Janumet price history table. There you’ll find that the lowest pharmacy price for Janumet is $100 cheaper than the highest, an annual savings of $1,000.

3. Shop for health insurance

With chronic illnesses such as diabetes, health insurance may be the best long-term cost-saving strategy for the uninsured. Visit your state’s health insurance marketplace for policy options. Check with an agent to make sure drugs like Janumet are covered at a reasonable out-of-pocket cost.

4. Consider Medicaid or Medicare Extra Help

If health insurance or Medicare Part D is challenging to afford, consider applying for Medicaid or Medicare Low Income Subsidy (LIS). Both involve minimally-priced premiums and out-of-pocket costs for treatments and drugs. Start by visiting your state’s Medicaid website for eligibility and enrollment information.

5. Ask the prescriber for medical advice about other antidiabetic treatments

If health insurance is lacking, asking the prescriber about other prescription drugs used to lower blood sugar is reasonable. Some may have been tried, but it may be worth substituting untried drugs before paying for expensive brand-name drugs. However, there may be reasons other drugs aren’t appropriate such as effectiveness, side effects, and drug interactions. That’s why getting the best medical advice is important before switching to generic alternatives.