Key takeaways

The Medicare “donut hole” was a coverage gap in Medicare prescription plans, where beneficiaries would pay a higher out-of-pocket cost for drugs after reaching a spending threshold.

In 2025, the Medicare donut hole was eliminated.

Medicare prescription plans now have three phases: deductible, initial coverage, and catastrophic coverage.

Update: The Medicare coverage gap, also known as the “donut hole,” was eliminated on Jan. 1, 2025. The remainder of this article’s content provides context as to what the Medicare donut hole was when it was in effect.

Donuts are great: They’re delicious and tasty treats. The donut hole, or the Medicare prescription drug coverage gap, which many people with Medicare fell into, was not great.

What was the donut hole in Medicare?

You may have heard the term in the past.

“The idea was that once you [and your plan] reached a pre-specified amount of spending on your prescription drugs, you had to pay for 100% of your prescriptions until you reached another pre-specified amount,” says Maria Polyakova, Assistant Professor of Health Policy at Stanford School of Medicine and a Faculty Fellow at Stanford Institute for Economic Policy Research.

However, the Medicare coverage gap, or donut hole, was eliminated as of January 1, 2025.

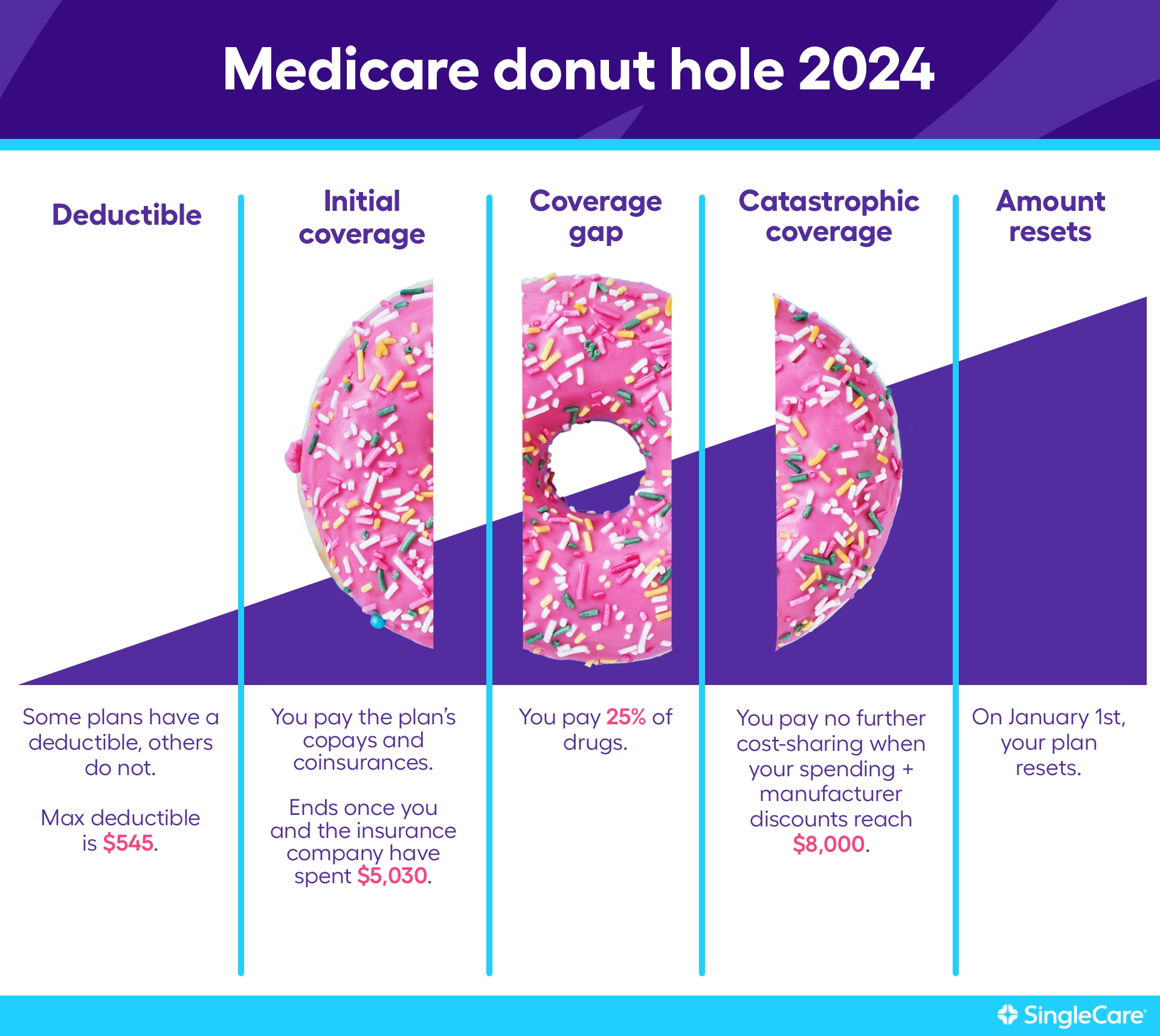

In 2024, you and your plan had to spend $5,030 in total on drugs 2024 to get to the donut hole. And if you got there, you paid 25%, not 100%, for your prescriptions.

You may be wondering why Medicare would have a donut hole at all. While the coverage gap closed in the years leading up to 2024 thanks to the Affordable Care Act (ACA), it was intended as a way to keep the cost of the program down when it was first passed by Congress. Here is a breakdown of what you could expect to pay in 2024 and what prices have been in previous years.

What was the Medicare Part D donut hole for 2024? |

|||

|---|---|---|---|

| Coverage stage | 2024 | 2023 | 2022 |

| Deductible | $0-$545 | $0-$505 | $0-$480 |

| Coverage starts after you reach your deductible | |||

| Initial coverage limit | You’ll reach the initial coverage limit when you and your plan pay… | ||

| $5,030 | $4,660 | 4,430 | |

| Coverage gap | You’ll pay 25% of drug costs until you and your plan spend … | ||

| $8,000 | $7,400 | $4,430 | |

| Catastrophic coverage | After you’ve spent $8,000, you pay no further cost-sharing | When your spending and manufacturer discounts reach $7,400, you’ll pay 5% for drugs or $4.15 for generics and $10.35 for brand-name drugs—whichever is greater | When your spending and manufacturer discounts reach $7,050, you’ll pay 5% for drugs or $3.70 for generics and $9.20 for brand-name drugs—whichever is greater |

Source: Medicare changes

Why was the donut hole eliminated in 2025?

The goal is to reduce out-of-pocket spending and make it easier for Medicare recipients to afford their medications. The change was a provision in the Inflation Reduction Act.

Who was affected by the donut hole?

The federal government sets coverage phases for Medicare Part D consumers for how their drugs will be paid for throughout the year.

Prior to 2025, you entered the donut hole when the total cost of your prescription drugs reached a predetermined combined cost. In 2024, that cost was $5,030. At that point, you would have paid a percentage of medication costs (25% in 2024) while you were in the Medicare donut hole.

The donut hole did not affect all Medicare beneficiaries. If you had Original Medicare only (Parts A and B) and didn’t have a Medicare prescription drug plan (Part D or a Medicare Advantage plan that includes Part D), the donut hole did not affect you.

If you had a Medicare prescription drug plan but total drug costs never reached $5,030 on covered medications, you were not affected by the donut hole.

Also, if you qualify for Extra Help, the donut hole never affected you.

What happened when you entered the donut hole?

If you found yourself in the Medicare donut hole, you needed to hit your out-of-pocket threshold. Once you met that cost, which was $8,000 in 2024, you had no further cost sharing. Specific costs were counted toward meeting this threshold to get out of the Medicare coverage gap.

Costs that counted toward getting out of the coverage gap include:

- Your plan’s deductible.

- Copayments and coinsurance for your prescription drugs.

- Manufacturer discounts from brand-name drugs during the donut hole period. To illustrate, if you have a manufacturer coupon for $50 off, this $50 was still applied to your total paid costs.

- Whoever else (i.e., family, charities, etc.) has paid on your behalf.

- Funds paid by state pharmaceutical assistance programs.

Costs that do not count toward getting out of the coverage gap include:

- Prescription drug costs that are not covered by your plan.

- The premium for your monthly Medicare prescription drug plan.

- Pharmacy dispensing fees.

RELATED: Medicare Part D costs

Medicare donut hole example

Let’s say you just signed up for Medicare Part D coverage and paid your first month’s premium. First, you paid 100% of all covered drug expenses until you met your deductible, which could have been $0 to $545 in 2024.

Once you reached your deductible, you entered the initial coverage period. You were then responsible for paying coinsurance or a copayment on the total cost of your covered prescriptions. Your Part D prescription drug plan covered the rest. Copays and coinsurance vary by plan.

When your out-of-pocket costs and the costs incurred by your plan reached a combined total of $5,030, you entered the Medicare Part D donut hole. You were now responsible for 25% of the costs of prescription drugs.

It was easy to reach the donut hole because the $5,030 initial coverage limit included your costs and your plan’s costs combined. It was more difficult to get out of the donut hole because the $8,000 catastrophic coverage limit included only what you had paid on covered drugs during the calendar year, not including your plan’s costs.

If your spending and manufacturer discounts reached $8,000, you’d be out of the donut hole and in catastrophic coverage. Your plan would have paid 100% of the cost of your medications as long as you remained in the catastrophic coverage phase.

Coverage lasts the full calendar year and resets on Jan. 1 of every year. If you’re unhappy with your drug plan, you can make changes during the open enrollment period, which is Oct. 15 to Dec. 7.

To put it simply, the left side of the donut was the sweet part where you paid your deductible and coinsurance or a copayment. The donut hole is where you usually paid a higher percentage of your total drug costs. The right side of the donut is when you could enjoy lower drug costs again.

How the Medicare donut hole was avoided

There were several ways Medicare Part D members could avoid falling into the donut hole.

1. Compare drug formularies before enrolling

Each Part D plan has its own drug formulary. Covered medications are placed on different tiers in the formulary. The cost of the drug increases for higher tiers. If you chose a plan with a formulary that includes most—if not all—of your medications and put your medications on lower tiers, you would have been less likely to enter the donut hole.

RELATED: What drugs are covered by Medicare Part D?

2. Choose generic drugs

Generic drugs are often significantly cheaper than brand-name drugs. If you chose generic drugs over brand names, you would have stayed out of the donut hole longer by paying lower copays or coinsurance.

RELATED: Are generic drugs as good as brand-name medicines?

3. Extra Help

You could also apply for the Medicare Part D Extra Help program, designed to lower Part D costs for those who meet specific income and asset criteria. If qualified, you wouldn’t pay monthly premiums or deductibles up to a certain amount. You would be responsible for only a small copayment of each drug. Go to the Social Security Administration’s website at ssa.gov to learn more about the other potential benefits of applying for Extra Help.

4. Patient assistance programs

While Extra Help is helpful for many, not everyone qualifies. There are a couple of other options, including state pharmaceutical assistance programs and patient assistance programs through various nonprofit organizations and drug manufacturers.

5. SingleCare

Another option is SingleCare, which provides members with up to 80% off prescription medications. You can’t use SingleCare in conjunction with any Medicare plan. However, you can use SingleCare instead of Medicare. Here’s when it may make more sense:

- If your prescription costs are higher with Medicare than with a SingleCare coupon: Use SingleCare.com or the SingleCare app to search for your medication before going to the pharmacy. If your healthcare provider already submitted your prescription to a more expensive pharmacy, simply call the most affordable pharmacy near you and ask them to transfer your prescription.

- If Medicare doesn’t cover your prescription: Medicare Part D plans do not cover all drugs. Some medications, like weight-loss and erectile dysfunction medications, will not be covered and could, therefore, be cheaper with SingleCare.

Lea este artículo en español aquí.

- Medicare.gov

- Extra Help with Medicare prescription drug plan costs, U.S. Social Security Administration

- State pharmaceutical assistance programs, Medicare Rights Center (2020)

- Prescription assistance, NeedyMeds